what taxes do i pay after retirement

There is a mandatory withholding of 20 of a 401 k withdrawal to cover federal income tax whether you will. Part is tax-free made up of.

Do I Have To Pay Taxes On Gains From Stocks Kiplinger In 2022 Paying Taxes Dividend Capital Gains Tax

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

. When you withdraw money from the retirement plan you will have to pay ordinary income taxes on those matched contributions. For example if you make an early withdrawal of 10000 at age 40 from your 401 k you will get about 8000. If youre collecting deferred compensation after retirement prepare for a hefty tax bill.

Retirement Planning and Your Taxes. Ax T Withholding You can. 24 Tips for Keeping More of Your Own Money.

For example singles with taxable income of up to 37950 or couples filing jointly with 75900. The rest of the. But if you have other income streams then some of your SSI may be taxed.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Currently federal income tax rates range from 10 to 37 percent depending on your income level and marital status. It can increase to 85 of your benefits if your income including half of your benefits is more than 34000.

As with other income distributions from traditional. Your entire benefit from a taxed super fund which most funds are is tax-free. Our tax law provides for a pay-as-you-go system which requires taxes to be paid on income as it is received.

Unlike certain types of income such as qualified dividends or long-term capital gains no special tax treatment is available for pension income. Under current law for 2018 the. For a single person making between 9325 and 37950 its 15.

Retirees with high amounts of monthly pension income will likely pay taxes on 85 of their Social Security benefits and their total tax rate might run as high as 37. How much are you taxed on RRSP withdrawals after retirement. The good news is.

New Look At Your Financial Strategy. Read this guide to learn ways to avoid running out of money in retirement. What is the tax rate on 401k withdrawals after retirement.

Alabama Taxes on Retirees. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. In fact my standard deduction would be 1700 higher if I were age 65 or older this year.

Expect to get hit with taxes on your retirement income from. Ad If you have a 500000 portfolio get this must-read guide by Fisher Investments. You may end up declaring as much as 85 of your Social Security income to be taxed.

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs and similar. If youre age 60 or over. 5 And if you have an employer-funded pension.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. There are two ways which taxes are typically paid. The amount you pay depends on on the.

Some of the taxes assessed while working will no longer be paid in. These distributions on top of other income can push retirees into a higher bracket. Yes Youll Still Pay Taxes After Retirement And It Might Be a Big Budget Item 2.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Tax on RRSP Withdrawals After 65. The short and general answer is yes individuals and couples generally have to pay taxes in retirement.

2 on up to 1000 of taxable income for married joint filers and up to. The IRS will withhold 20 of your early withdrawal amount. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Both your income from these retirement plans and your earned income are taxed as ordinary income at rates from 10 to 37. State Income Tax Range.

Taxes on Pension Income. Then the next bucket of. If you take money from your RRSP the government will charge a withholding tax.

Everyone working in covered employment or self-employment regardless of age or eligibility for benefits must pay Social Security taxes. Lets say your employer puts aside 10000 of your annual salary in deferred compensation. Married taxpayers who file joint returns are taxed on 50 of.

Avoid Taxation You can avoid taxation on your Roth 401k. Visit The Official Edward Jones Site. A single person making between 0 and 9325 the tax rate is 10 of taxable income.

If your annual income exceeds 34000 44000 for married couples 85 of Social Security benefits may be taxed. Whether you choose to start withdrawing from your RRSP at age 65 standard retirement age or earlier funds withdrawn from your RRSP. The first 9950 of taxable income would only be taxed at 10.

Long-term capital gains taxes apply to investments that youve owned for more than a year and are taxed at a lower rate -- 20 if youre in the highest tax bracket 0 if youre.

Savvy Tax Withdrawals Fidelity Lifetime Income Saving For Retirement Tax

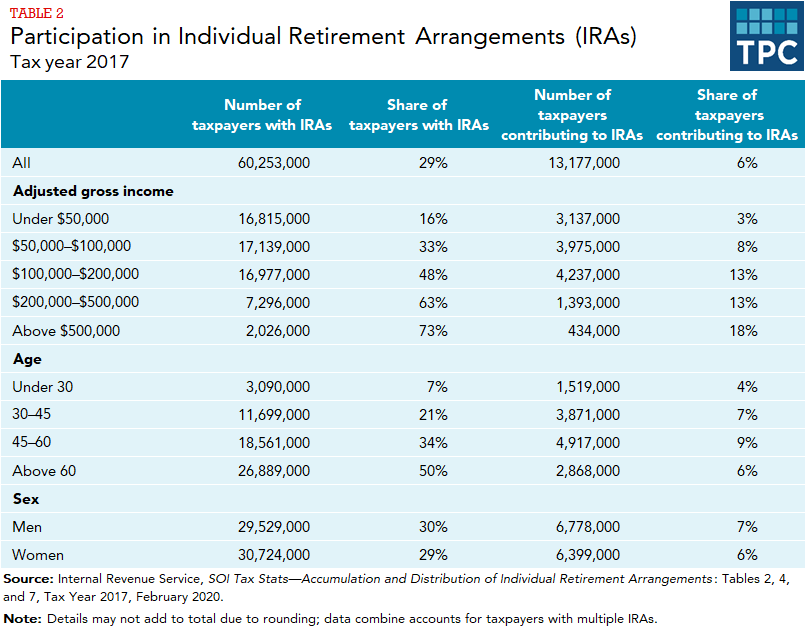

What Kinds Of Tax Favored Retirement Arrangements Are There Tax Policy Center

Tax Filing Tips For Saving Money On Your Taxes Filing Taxes Free Tax Filing Money Saving Tips

After Tax Investment Amounts By Age Guide To Retire Early Comfortably Financial Samurai Investing Early Retirement Retirement

Withdrawals Of Pre Tax Money Including Contributions Employer Match Profit Sharing And Rollovers In A Workplace Retirement Benefits Tax Money Contribution

Roth Ira Conversion After 50 Fidelity Investments Roth Ira Conversion Roth Ira Roth

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax

Tax Withholding For Pensions And Social Security Sensible Money

Do I Need To Pay Taxes After Retirement Liberty Tax Service Sales Jobs Life Insurance Beneficiary Tax Services

Tax Withholding For Pensions And Social Security Sensible Money

What Kinds Of Tax Favored Retirement Arrangements Are There Tax Policy Center

Tax Withholding For Pensions And Social Security Sensible Money

This Chart Tells You How Basic Investment Accounts Are Taxed Budgeting Money Investment Accounts Investing

States That Don T Tax Social Security Benefits Social Security Benefits Social Security Social

How Much Can We Earn In Retirement Without Paying Federal Income Taxes Early Retirement Now Federal Income Tax Income Tax Capital Gains Tax

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age